Just financial advice for young adults and family starters

just advice:

i won’t manage your money, nor will i turn you away for not being rich

just(in):

that’s my name, don’t wear it out

just investing:

i will help you invest aligned with your values, not against them

Proud member of

Independent

Advice-only

Fee-only

For you. For anyone.

At Just Advising, I put you at the front of everything.

Just Advising is a virtual, independent, financial planning practice where the only service offered is just advice at a flat fee. You’ll never be sold a product, asked to let me manage your money, commit to a long-term engagement, or be turned away because of your net worth.

Here, you are valued for who you are, not how much I can profit off of you.

Commissions

Hidden fees

Asset minimums

Meet the planner and the practice

Young adults and family starters

Do any of these sound familiar to you?

Starting your career

This is for young adults navigating graduation, first couple of “real” jobs, and financial independence.

Do you feel like you don’t know where your money goes each month but hate budgeting?

Have you recently graduated with student loans and don’t know how you can afford to live on your own?

Do you have other types of debt and are wondering about the best strategy to pay it off?

Did you just start a new job and don’t know what benefits are best for your life?

Did you just leave a job and are concerned about what’ll happen to your old insurance and benefits?

Sharing your life

This section speaks to couples who are getting serious, getting married, or merging financial lives.

Do you and your significant other approach money differently and disagree more than you’d both like?

Are you both thinking about combining finances but aren’t sure about the best way to do it?

Are you both getting excited for marriage but wondering how it’ll impact your taxes?

Have you both thought about what would happen if one of you got sick and couldn’t work for some time?

Do you both dream of getting a house or taking a vacation but feel like it’s impossible to afford?

Growing your family

This is for new parents or those planning for children, facing new financial priorities and responsibilities.

Do you or your significant other want to be a stay-at-home-parent but you don’t know if its affordable?

Did you just have a baby and are wondering about the best way to prepare for education costs they’ll have?

Does your child have special needs and you’re worried about how you can keep their government benefits?

Are you and your significant other new to parenting and concerned about what’ll happen if one or both of you die unexpectedly?

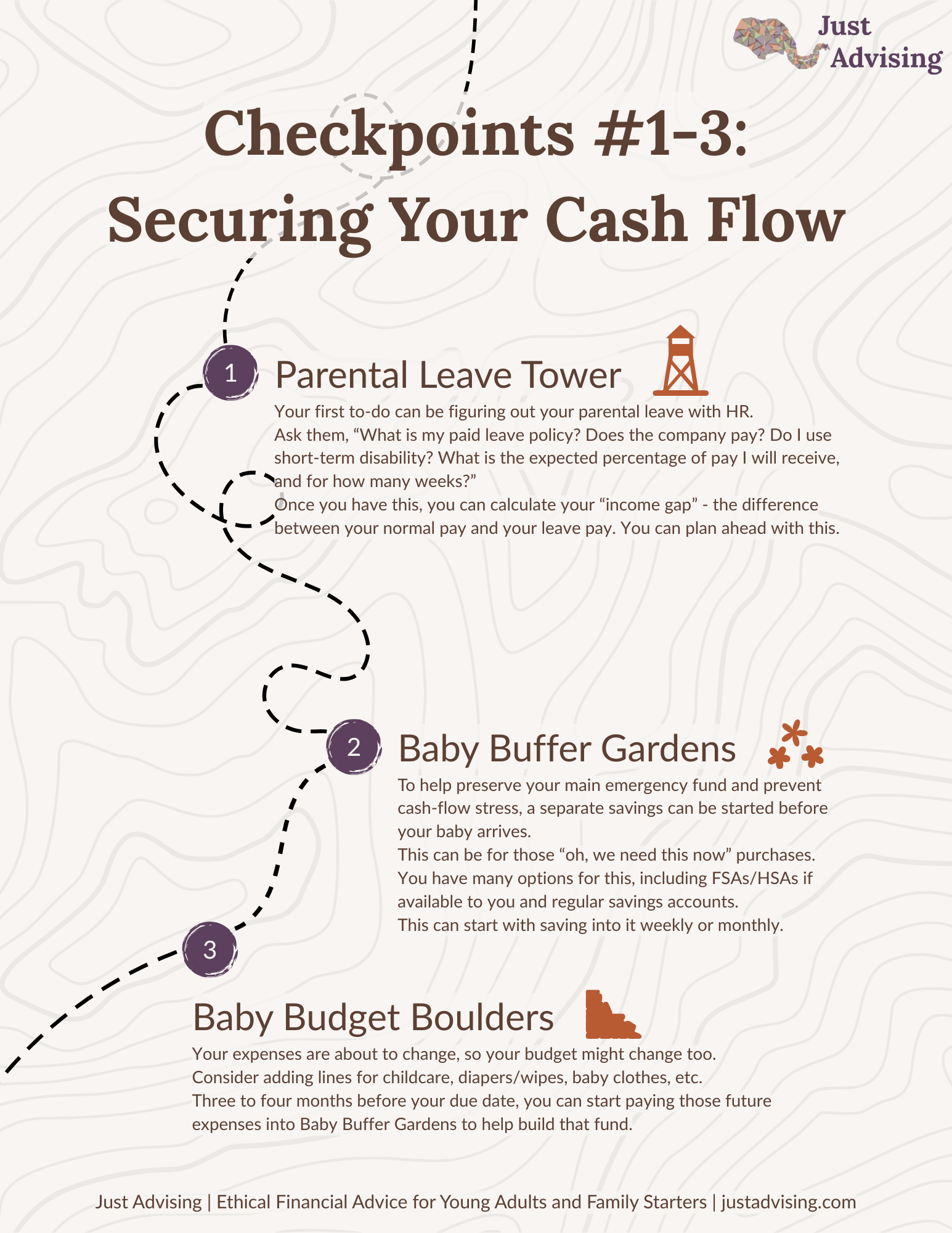

Financial trail guide for new parents

Life as a new parent adds a lot of stress and uncertainty. But, it doesn’t have to be approached alone. Click below to download a free copy of my New Parent Financial Trail: A Simple Guide for Family Starters. This educational guide runs through ten checkpoints spanning how you can prepare and what you can do after your little one arrives.

Just financial advice

Money is a tool. It can be used for school, bills, retirement, gifts, and more. But, you can also use money in line with your values to create positive change in the world. You might not write government policy or lobby politicians, but you can invest in ways to encourage positive change in the world. Welcome to the the Environmental, Social, and Governance (ESG) space of investing. Or as I refer to it here, ethical investing.

Research has shown that when investors (you) invest money towards ESG initiatives, it can influence just , fair, and sustainable change within a company’s policies and practices. At Just Advising, one of the areas I focus on is ethical investing advice.

Streamlined services

Everyone starts with a free 30-minute Icebreaker conversation. This helps us find out if we’re a right fit and what service is best for you!

The Waypoint

Perfect for a specific fork in the road.

Do you have a few burning questions but aren't ready for a full comprehensive plan? This is an hourly engagement designed to get you unstuck and moving forward.

Includes:

A focused 1-2 hour strategy session

A clear, jargon-free summary report

Answers to specific questions

The Expedition

Designed for a long-term financial journey.

Ready to get organized and align your money with your values? This is a deep dive into your financial picture to build a foundation for your future.

Includes:

Three collaborative meetings (Discovery, Review, & Advice)

A rounded, actionable Financial Plan

A follow-up check-in session

Transparent and simple fees.

All fees are a one-time payment, per project, based on which service you choose.

30-minute Icebreaker

$0

Everyone starts with a free 30-minute Icebreaker chat to see if we’re a right fit!

The Waypoint

$150/hour

The Expedition

The fixed-fee for this service depends on your status below.

Individual

For individuals with no children

$1,800

Couple

For married and non-married couples with no children

$3,000

Family

For a couple or an individual with children

$3,600 for couple | $2,400 for individual

The Expedition

The fixed-fee for this service depends on your status below.

Individual

For individuals with no children

$1,800

Couple

For married and non-married couples with no children

$3,000

Family

For a couple or an individual with children

$3,600 for couple $2,400 for individual